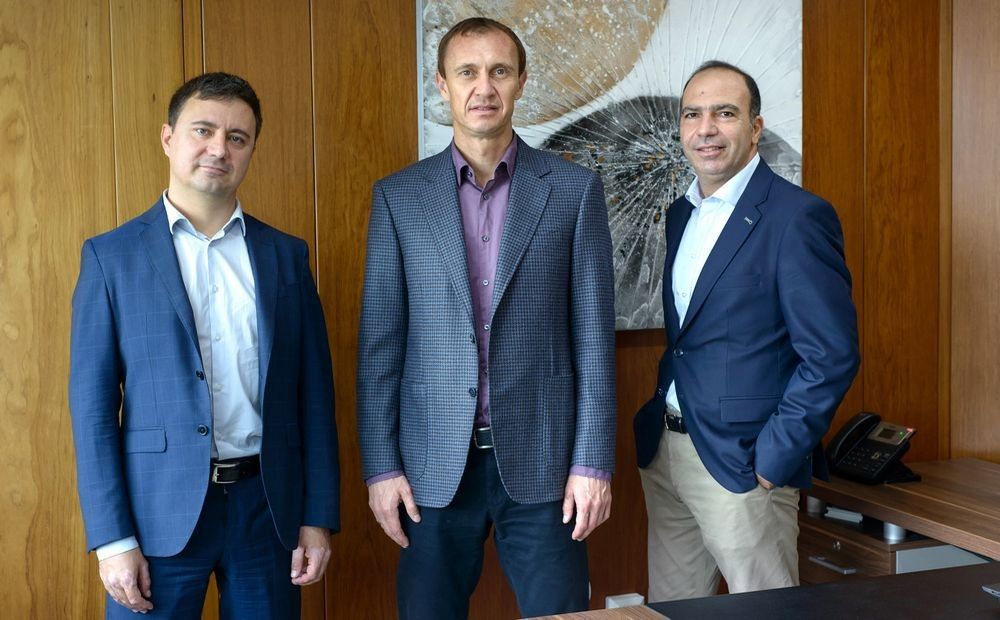

The fund industry in Cyprus has been steadily growing in recent years. However, there are still gaps in the local market in terms of the investment strategies offered to investors. Successful Business spoke to Andrey Narutskiy (AN), CEO and Executive Director, Mikhail Borisov (MB), CIO and Portfolio Manager, and Demetris Nicolaou (DN), Head of Business Development at LEON MFO Investments Limited about the situation in the market and how they plan to enhance the investment offering to wellinformed and professional investors.

As an entity established in Cyprus, how do you see LEON’s role in the local market?

AN: We started as a multifamily office in 2013 and over the years have developed strong wealth management expertise by investing ultra-high-networth individuals’ (UHNWIs) liquid assets in global capital markets. We aim to replicate the established successful investment strategies in fixed income and hedge funds in collective funds schemes. We want to do it in Cyprus to support the fund industry here and help it grow. We could have implemented our strategies in Luxembourg which is a more established fund jurisdiction.

However, we decided to launch the first funds on the island and bring our expertise to the local market.

How many funds and of what type do you have now?

Currently, we have three funds that are already closed, so we are not accepting new subscriptions from new investors. At the moment, we are launching two new funds that will be open to subscriptions. One of them provides an opportunity to invest primarily in U.S. corporate bonds. The other deals with investing in a diversified portfolio of hedge funds.

MB: The LEON Global Hedge Fund is built on our expertise accumulated in LEON for over 3 years and on my personal experience of 10 years in hedge fund strategies. We have decided to focus on private credit because we believe that in this area the most stable excess returns can be earned. This is all due to the ongoing process of banks retreating from these businesses following Basel III regulations. The fund industry has a solution and we want to capitalise on the existing opportunity.

How do the strategies of the two funds differ?

While the first one invests directly in U.S. corporate bonds, the hedge fund invests in companies that, in turn, invest in private credit. One companybuys another’s receivables at a discount and essentially earns a yield on that. It is similar to the fixed income strategy that earns a yield but very different in terms of risk drivers and sources of return. For the hedge fund, the key is managing liquidity risk and credit risk.

The focus will be on selecting the most reliable partners, checking all the processes, verifying the information, and arranging favourable terms for us and our investors.

Besides expertise, what other security guarantees could you provide to people trusting you with their financial assets?

The standard security a fund can offer is a set of regulations. We are tightly regulated both at a firm’s and at each fund’s level. We have a comprehensive infrastructure of custodians, auditors, and counterparties. In addition, with the hedge fund, most of the strategies imply that loan arrangements should be collateralised. In terms of credit risk, this approach provides a much higher level of security than investing directly in bonds.

DN: I would say that both strategies were missing from the local market. There are many investors who still keep their money in local banks getting a nextto-zero return. We provide an option for investors to explore international bond and credit markets with well-diversified products and a possibility to achieve returns well above the minimum that they get from the banks.

What would be the specific benefit for investors participating in LEON’s new funds?

DN: It is important to mention the expertise of the team managing the funds, the ease with which investors can subscribe, manage, and invest in these funds, as well as transparency, investor protection, and regulations.

MB: It is a unique product that offers investors a risk-return profile that is usually hard to access, especially in the hedge fund’s case. Normally, the minimum subscription is €1 million per fund.

Building a diversified portfolio would require €10-15 million from the investor. Our minimum threshold is much lower.

AN: We already have a distinguished track record. We have built a successful wealth management business; LEON currently manages €1 billion in individual portfolio management. This has been achieved within 8 years. Now we are launching a new line of business based on a solid platform, on the backbone of our existing business. It gives us credibility. We also have seed capital from our existing individual investors. All the funds that we are launching will have €5-10 million of seed capital.

What differentiates us from global fund players is that our fund managers are physically based in Cyprus, they can be easily reached at practically any time. Investors can always contact us and get instant updates which is another big advantage.

What size will the funds be?

Our target is to raise €100 million within 3 years for each fund, but the sky is the limit at this stage.

LEON MFO Investments Limited is regulated by the Cyprus Securities and Exchange Commission.

License No. AIFM 37/56/2013

Tel.: +357 25 268 120

www.leoninvestments.com.cy