Today digital assets are affecting the entire financial market. Will they create opportunities for economic growth? How will financial services industry models change? Is the regulatory structure over financial services prepared for this change? Deloitte’s 2021 Global Blockchain Survey provides a clearer view at current and future expectations for the global financial services industry (FSI).

The survey focuses on respondents from the FSI and FSI Pioneers – respondents, whose organisations have already applied blockchain solutions and/or integrated digital assets into their business activities.

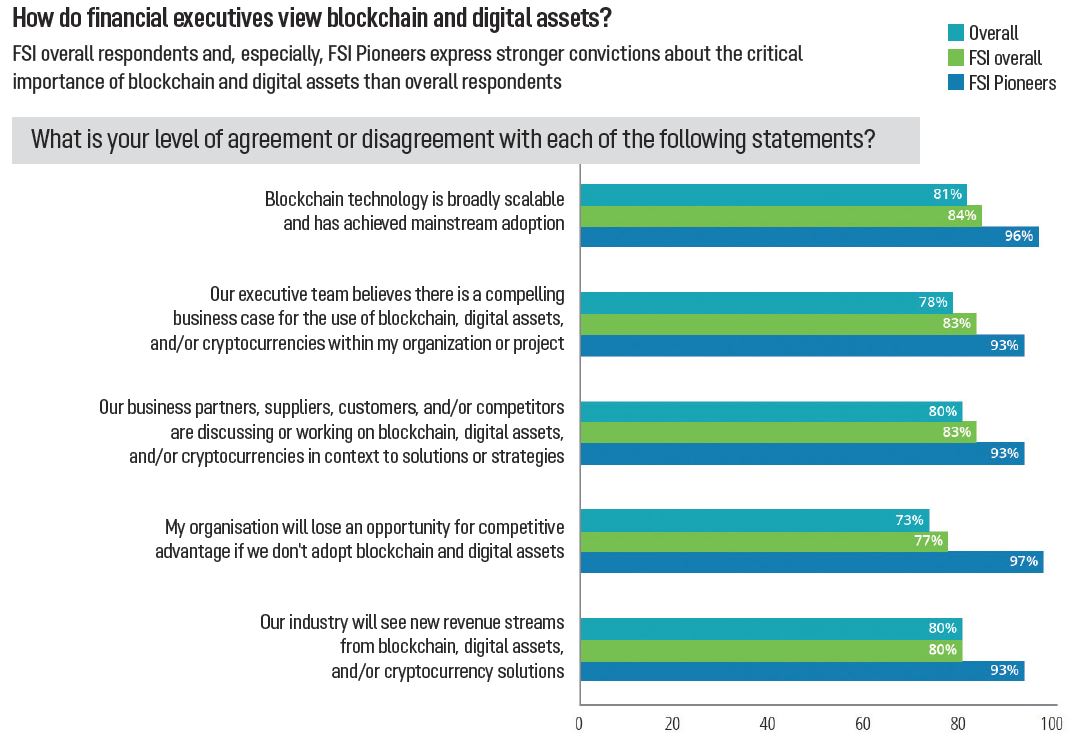

More organisations realise that adopting blockchain and digital assets becomes necessary for their business models. According to the survey’s results, more than three quarters of FSI respondents strongly or somewhat agree that their organisation will lose an opportunity for competitive advantage if they fail to adopt blockchain and digital assets.

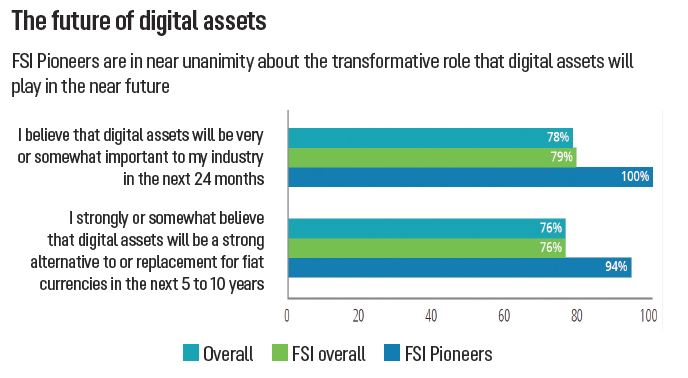

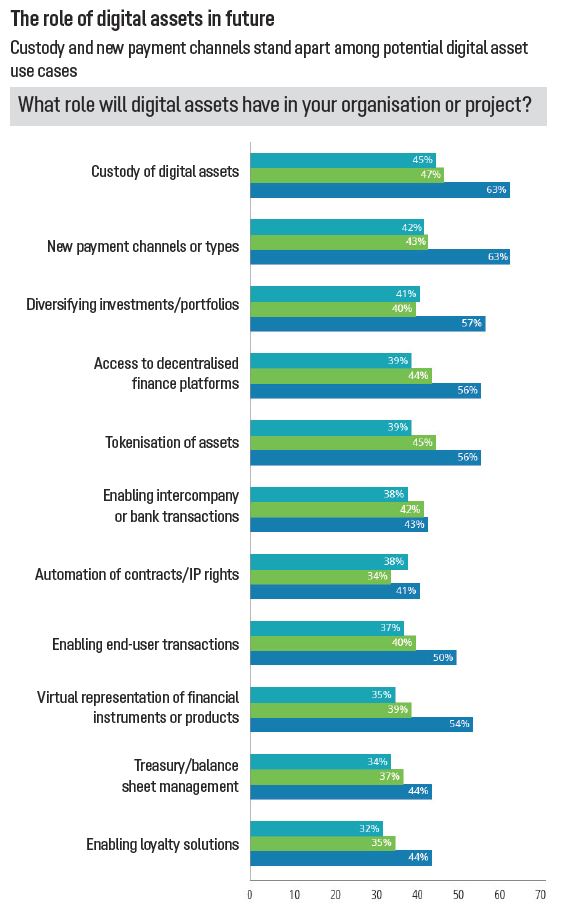

The shift to digital assets is fundamentally changing banking. Banks need to rethink their business models around the payments since cross-border transactions can be performed outside the traditional banking system. 43% of FSI respondents say that new payment options represent a ‘very important’ role for digital assets in their organisations.

Among FSI Pioneers that figure jumps to 63%. 76% of the survey respondents and 85% of FSI Pioneers believe that digital assets will help significantly or moderately reduce risks for organisations or projects. But this optimism is also tempered by caution. 71% of overall survey respondents identified cybersecurity among the biggest obstacles to acceptance of digital assets. 67% of FSI Pioneers agreed which means that even those who are already implementing digital assets and believe in their future have serious security concerns. Around 70% of overall survey respondents identified data security regulation in the greatest need of modification (vs 63% of FSI Pioneers).

The Deloitte’s Global Blockchain Survey shows that respondents expect to observe significant positive impact on their organisations and projects from a variety of digital asset types:

• Stablecoins or central bank digital currencies: overall survey 42%; FSI overall 43%; FSI Pioneers 53%

• Algorithm-driven stablecoins: overall survey 38%, FSI overall 40%, FSI Pioneers 59%

• Enterprise-controlled coins: overall survey 33%, FSI overall 33%, FSI Pioneers 43%.

This thinking creates anxiety about how the industry can adjust traditional processes, products, and services to effectively meet their customers’ future needs. An impressive 97% of FSI Pioneers see blockchain and digital assets as another way to gain competitive advantage.

The future is happening now. But it will depend on the industry players and on their reactions. What the industry does now will shape financial services, the nature of money, and the nature of financial economic activity for the next decade. Participation in the age of digital assets is not an option. Leaders need to decide how and when their organisations should start using digital assets to their great advantage.

Deloitte conducted its 2021 Global Blockchain Survey in 10 locations: United States, United Kingdom, Germany, China Mainland, Japan, UAE, Hong Kong SAR, Singapore, Brazil, South Africa. In total, 1,280 senior executives and practitioners took part in it.

The full survey can be accessed at www2.deloitte.com