Blockchain technology enables the digital ownership, transfer, and storage of assets without the necessary need of a central third party or intermediary. The attributes of this technology, wrapped nicely with token interface standards such as that of NFTs, are revolutionising the ownership of real and virtual word assets. It is possible to tokenise a real estate deal in Cyprus, or even to purchase land in a virtual world. Not only that, through Apps, blockchain technology has pushed to revolutionise the financial products and financial concepts as we know them, where Web3 ecosystem is creating the future of finance in the DeFi sector.

Blockchain technology enables the digital ownership, transfer, and storage of assets without the necessary need of a central third party or intermediary. The attributes of this technology, wrapped nicely with token interface standards such as that of NFTs, are revolutionising the ownership of real and virtual word assets. It is possible to tokenise a real estate deal in Cyprus, or even to purchase land in a virtual world. Not only that, through Apps, blockchain technology has pushed to revolutionise the financial products and financial concepts as we know them, where Web3 ecosystem is creating the future of finance in the DeFi sector.

THE NFT HYPE – JUST THE BEGINNING?

Without a doubt, year 2021 has been the year of non-fungible tokens, commonly known as NFTs. There has been an explosion of news on how Nyan Cat has being sold over and over as a one-ofa-kind piece of crypto art. As of the time of writing this article the last sell price is at 300 ETH, approximately $1.3 million. We have seen the CryptoPunks, 10,000 uniquely generated characters create havoc amongst crypto enthusiasts while everyone was trying to own one, where current floor price touches $500,000. Owning a Bored Ape grants access to a private Yacht Club with benefits only members can have. Not only that, wellknown artists launch their own new art pieces, while leveraging art digitisation and the blockchain technology, such as the Currency.

While the art at the beginning exists in both physical and digital forms, the owner of the NFT must decide within a certain timeframe which one of the two to keep, as only one can exist, according to the artists’ own set

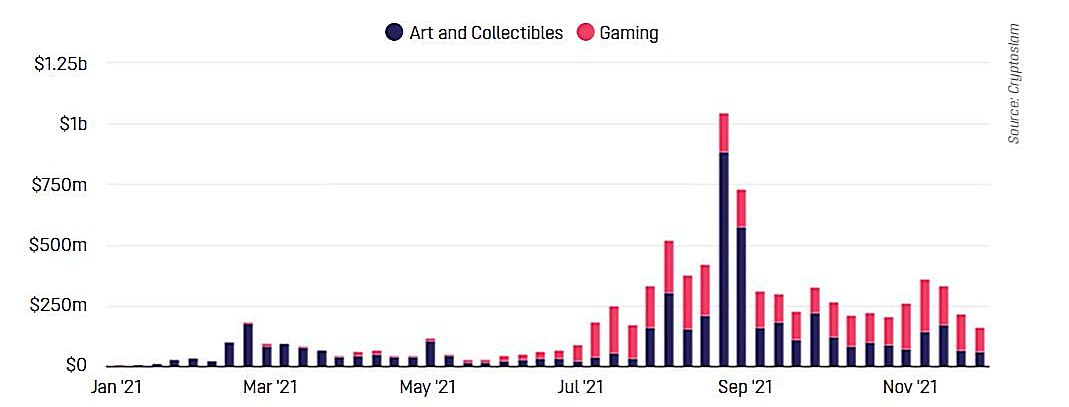

of rules. According to 'The Block', a leading research, analysis, and news brand in digital assets space, the interest in NFTs boomed in the second half of the year, reaching weekly trading volume of $250 million worth of NFTs (Figure 1), close to $7.7 billion total volume in just six months.

FIGURE 1. WEEKLY TRADE VOLUME OF NFTS BY CATEGORY

Putting all the buzz aside, this new application concept of blockchain technology is revolutionising the ownership of real and virtual world assets. In the most abstract form, tokenisation converts the value stored in tangible or intangible objects into non-fungible tokens which per definition are unique, irreplaceable, and non-interchangeable with any others. Owning the NFT of an asset enables the digital ownership, transfer, and storage of the asset, without the necessary need of a central third party or intermediary.

WHAT ABOUT METAVERSE?

Alongside NFTs, ‘metaverse’ seems to be gaining significant momentum. We have recently seen social platform Facebook renamed to ‘Meta’, in an attempt to reflect the focus of the company into metaverse. The term ‘metaverse’ is often traced to Neal Stephenson’s 1992 science fiction novel, the ‘Snow Crash’. Many often relate it to a more recent inspiration, the Earnest Cline’s 2011 novel, ‘Ready Player One’, directed by Steven Spielberg. Metaverse is a place where our physical world blends with a virtual one, where people become what they dream of in their everyday lives. Using Virtual Reality (VR), Augmented Reality (AR) gadgets and not only, people can express their inner selves by creating 3D avatars that live in this virtual word. The metaverse is set to include realistic and interactive assets, the ability to move from one place to another and even take advantage of strategy and problem-solving in a digital setting. That is where NFTs, the digital collectables, come into play. Not all, but in many cases, the NFTs will be integrated into such virtual worlds, taking advantage of the ownership and allowing the usage of such assets within a metaverse world.

We have already seen metaverse worlds in the form of a game, even virtual music concerts. Metaverse tokens have been on the rise. There are cases where players can build, own, and monetise their time and in-game achievements. The paradigm of play-to-earn is set to grow multi-fold in the coming years. Metaverse is growing strong. Figure 2 shows a glimpse at the current ecosystem participants.

WEB3 ECONOMY

Starting with the NFTs, to playing and attending concerts in virtual worlds, the Web3 ecosystem is expanding in new ways and models for creators and communities to monetise. When referring to Web3, it is often noticeable that cryptocurrencies are part of the conversation. That is because Web3 applications either run on blockchains, decentralised networks, or numerous peer-to-peer computers. These applications are often referred to as dApps or decentralised applications.

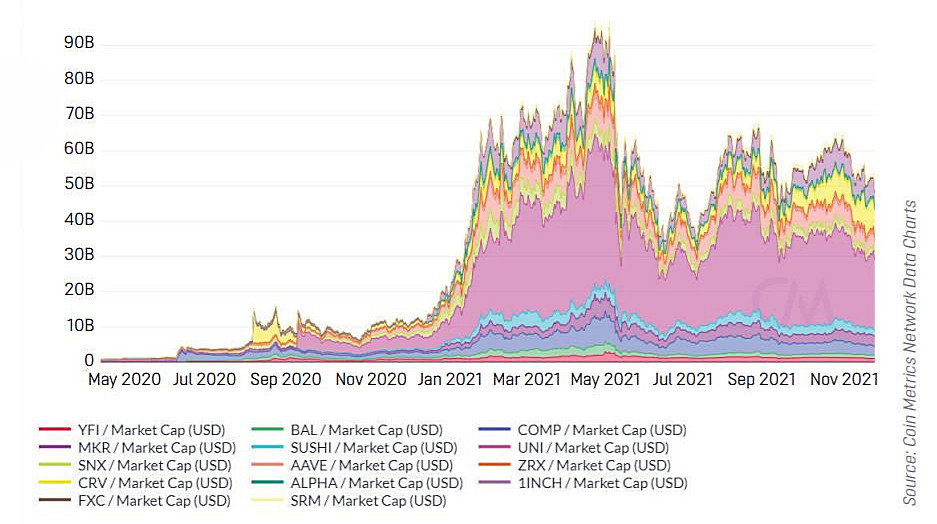

The growth of dApps has greatly started to alter the financial industry. Decentralised Finance or simply, DeFi, is the financial ecosystem built on blockchain applications. They consist of a combination of traditional financial products and financial concepts, as known from the banking sector, integrated with blockchain technology. And this is only the beginning. The distributed nature, the no need for a third trusted party and the security the technology provides via smart contracts, is creating the perfect environment to build new and more complex financial products. DeFi platforms allow to lend or borrow funds from others, speculate on price movements on a range of assets, insure against risk and even earn interest in several mechanisms such as yield farming and liquidity mining. Although it may seem that DeFi started in 2020, it has been around since early 2018. According to Coinmetrics, a provider of crypto financial intelligence, DeFi’s significant rise began in July 2020, and continued until May 2021, where the market cap peaked close to $95 billion (Figure 3). We are currently at early stages of the future financial industry, where the regulation of such products is still minimum and DeFi entitle high level of risk, therefore should be used with caution.

FIGURE 2. METAVERSE ECOSYSTEM DIAGRAM

AND WHAT ABOUT CYPRUS?

The Republic of Cyprus to be in line with the European and global trends and technological advancements, is adopting innovative practices and procedures. The ‘Distributed Ledger Technologies (Blockchain) – a National Strategy for Cyprus’ is paving the route and contributes towards making the island in the Mediterranean a regional hub for technology companies.

As early as now, we have seen digital transformation in the healthcare sector. A blockchain enabled medical data management platform has been implemented and used by a Cyprus hospital, allowing patients to identify themselves automatically at the Emergency Room registration desk, check their queue on mobile phone, and safely manage their own medical records.

FIGURE 3. DEFI MARKET CAP

Real estate industry has already been disrupted as well. A US-based company specialising in enterprise cryptocurrency blockchain software, announced that they will tokenise real estate deals in Cyprus in the form of NFTs. The tokens issued will be backed by actual, physical real estate and the goal is to access the future value of the real estate deal once the project is constructed. This method will allow real estate developers to raise capital at better terms and allow the token holders to raise appraisals and earn income.

I strongly believe that Cyprus is an emerging technology hub in the region. The implementation of the National Blockchain Strategy, in combination with several other incentives already offered, create a unique opportunity to tech companies. What would help accelerate the development of this technology hub is the design and construction of a Tech Valley. A campus where tech companies would occupy physical spaces, founders and teams will be able to have access to mentorship, trainings, education. To create a valley of companies and likeminded entrepreneurs and of course to attract investment capital.

Cyprus is proactively developing modern legislation and policies, aiming to attract state-of-the-art cryptocurrency companies and talents across all the board of professions. At Quonota Investments, we believe that Cyprus has enormous potential to become a stronghold hub for Blockchain Technology businesses, by creating an ecosystem for investors, developers, and entrepreneurs alike. With the newly implemented crypto legislation this is becoming a reality and now it is the right time to become part of it by relocating to Cyprus.

Quonota Investments, a family office and investment firm, is based in Limassol, the tech city of the island, with a blend of historic and ultra-modern architecture and tradition. The firm is an active investor in the digital assets industry and avid supporter of blockchain technology. We invest in the bold, the brave and exceptional – the defining ideas of today and tomorrow. We help with money, mentorship, and shared learning from people who have walked in these shoes before. Our goal is to become an epicentre for innovation investing, with the best connected networks to help support our portfolio companies.

18 Maximos Michaelides St., Tower II, Maximos Plaza, Limassol 3106 Cyprus

+357 25 731880

Этот адрес электронной почты защищён от спам-ботов. У вас должен быть включен JavaScript для просмотра.

www.quonota.com